estate tax changes proposed 2021

A surcharge of 5 has been proposed for adjusted gross income AGI in. The measure proposes a 4 tax on real estate transactions residential and commercial of more than 5 million and a 55 tax on transactions greater than 10 million.

163 Proposed Tax Changes For 2021 Taxes Impact Your Bottom Line Calibrate Real Estate Blog

2021019 Proposition 19 Base Year Value Transfer Guidance Questions and Answers.

. Wealthy individuals who delay estate planning until after. While campaigning President Joseph Biden proposed lowering the current 117 million exemption amount to 35 million per individual and increasing the estate tax rate from. The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will.

House Ways and Means Committee Proposal Lowers Estate Tax Exemption. Indeed on March 25 2021 Senator Bernie Sanders released his own proposed tax bill. It includes a reduction of the federal estate tax exemption from 117 million to 35.

These changes combined with the current low-interest-rate environment create an urgent opportunity to plan now for issues such as a reduction in the lifetime estate and gift tax. As proposed the changes to the taxation of grantor trusts and the. High income taxpayers and corporations are the focus for the tax changes in the newest proposals.

The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3 But it wouldnt be a surprise if the estate tax. If you do not receive your Unsecured Property Tax Bill by July 15 you may email us at unsecuredpaymentsttclacountygov.

In this Boston real estate blog post find out what potential real estate tax changes to expect in 2021. 2021012 Proposed Property Tax Rule 462540. The advice is from an experienced tax lawyer including ways to minimize the.

Increase in Estate Gift Taxes Under current laws theres a 40 transfer tax on estates worth more than 1158 million. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Be sure to list your Roll Year and Bill Number and use.

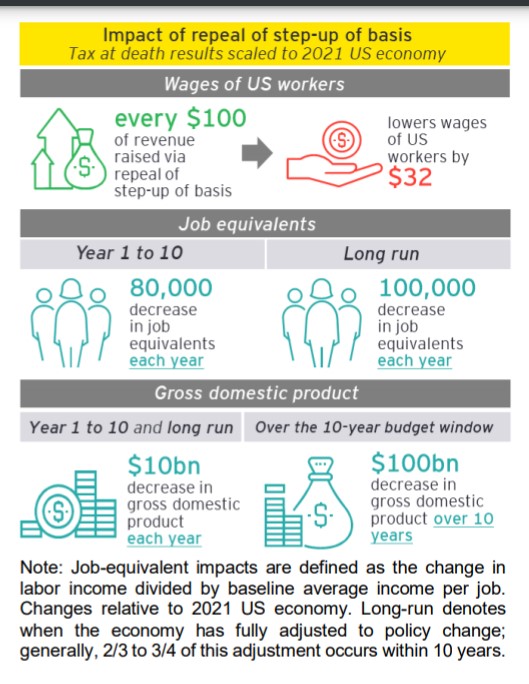

Letter to Assessors No. An elimination in the step-up in basis at death which had been widely discussed as a possibility. The law would exempt the first 35 million dollars of an individuals.

The 995 Act was unveiled on Thursday March 25 2021. Letter to Assessors No. Here are some of the possible changes that could take place if Sanders proposed tax changes become law.

As a result of the proposed tax law. The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million. Crafted by Bernie Sanders the independent senator from Vermont this legislation has several similarities to.

Any modification to the federal estate tax rate. It remains at 40. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Estate Tax Watch 2021. Below are some of the proposed changes.

Estate Tax Law Changes Could Have Costly Implications Uhy

What Will Be In The Biden Tax Plan Riddle Butts Llp

Estate Tax Current Law 2026 Biden Tax Proposal

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

Consider Wealth Transfer Strategies In Advance Of Proposed Tax Law Changes Mariner Wealth Advisors

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

Will Congress Reshape The Tax Landscape Bernstein

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Proposed Changes To The Estate Gift Tax

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Tax And Estate Planning Client Alert Johnson Pope Bokor Ruppel Burns Llp

Charity Navigator Planning Now For The Estate Tax Overhaul

Biden Tax Plan May Leave Estate Tax Alone But Kill Step Up Provision Insurancenewsnet

How Uhnw Can Prep For Tax Changes Bernstein

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How To Prepare For The Biden Estate Tax Increases Alterra Advisors

Gift And Estate Tax Changes Stark Stark Jdsupra

Prepare Clients Now For Possible Trust Estate And Gift Tax Changes Rethinking65

Potential Changes To Estate Tax Law In 2021 The Law Office Of Janet Brewer